All about Advance Tax:

Due Dates, Applicability, Procedure, Installment Details.

Please enter you details

What is Advance Tax?

| Point | Description |

|---|---|

| Definition | A system of paying income tax periodically throughout the year. |

| Applicability | Required if total tax liability exceeds ₹10,000 in a financial year. |

| Who Should Pay | Salaried individuals, freelancers, businesses, except senior citizens. |

| Purpose | Ensures timely tax payments, helps avoid penalties and manage cash flow. |

| Presumptive Income Taxpayers | Pay entire tax liability by 15th or 31st March under sections 44AD/44ADA. |

Who Should Pay Advance Tax?

Salaried individuals, freelancers and businesses

Senior citizens

Presumptive income for businesses

Presumptive income for professionals

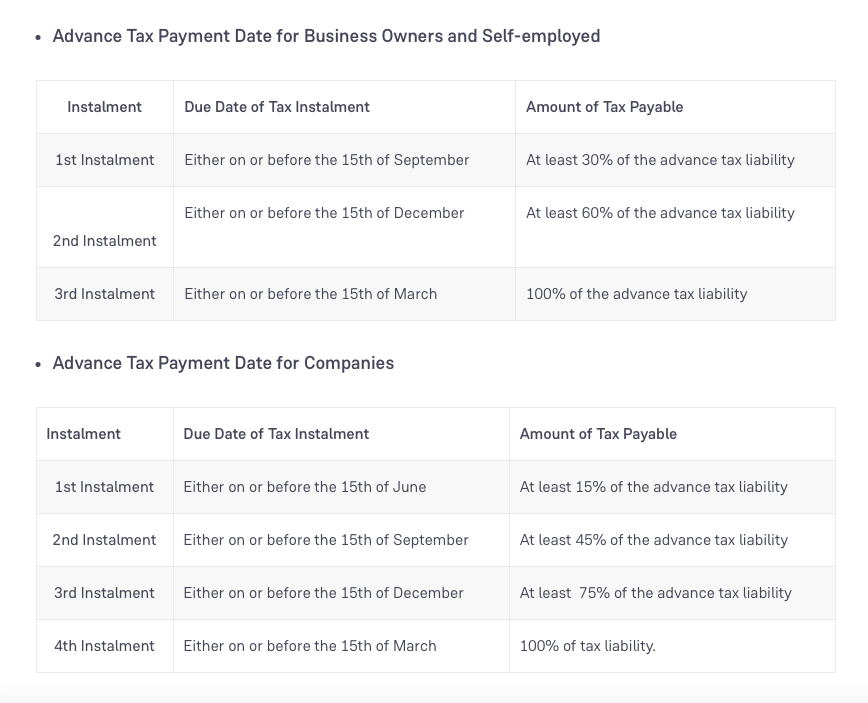

Advance Tax Payment Due Date & Amount

Why Pay Advance Tax?

Avoid Penalties

Smooth Cash Flow

Compliance

Peace of Mind

TaxSpanner

Since 2007

Established in 2007, TaxSpanner is India’s largest and most trusted website that offers online preparation and filing of individual Income Tax Returns (ITR). We are registered with the Income Tax department of the Government of India as an e-return intermediary.

Let ushelp you with Advance Tax compliance

Our Contacts

For any queries on:

managing and saving taxes,

contact us!

DISCLAIMER: File your Income tax return online with TaxSpanner. E-filing with TaxSpanner is easy, secure and fast. Upload Form-16 and file within 15 minutes. TaxSpanner covers salary income, bank and other interest income, capital gains, house property income, business and professional income. Start filing for free, and be assured of maximum refund, guaranteed. We are the best tool for individuals to e-file their tax return. We are authorized e-return intermediaries of the income tax Department, Government of India and are committed to give you the best e-filing experience.